On Tokenization and Economic Prosperity

Long-tail asset tokenization is an exciting, but often overlooked, application of blockchain technology. In this article, we'll explore why tokenizing these assets could become one of the first "killer use cases" that propels blockchain-based applications into the mainstream. While there are numerous projects tokenizing various asset classes, we'll focus on one company leading the way in high-end wine and spirits tokenization.

We’ll explore how tokenization enables global markets, global credit, and finally the economic impact associated with these innovations.

Enablement of Global Markets

At this very moment, billions of dollars of valuable wines and spirits are currently sitting unopened in private homes around the world. While these items hold significant value, the methods by which that value can be unlocked have not existed until recently.

The primary avenue for selling these types of assets today are physical auctions. This creates a multitude of issues, including but not limited to:

Illiquid local markets and supply

Hassle of getting yourself and your bottles to an auction physically

Exorbitant fees

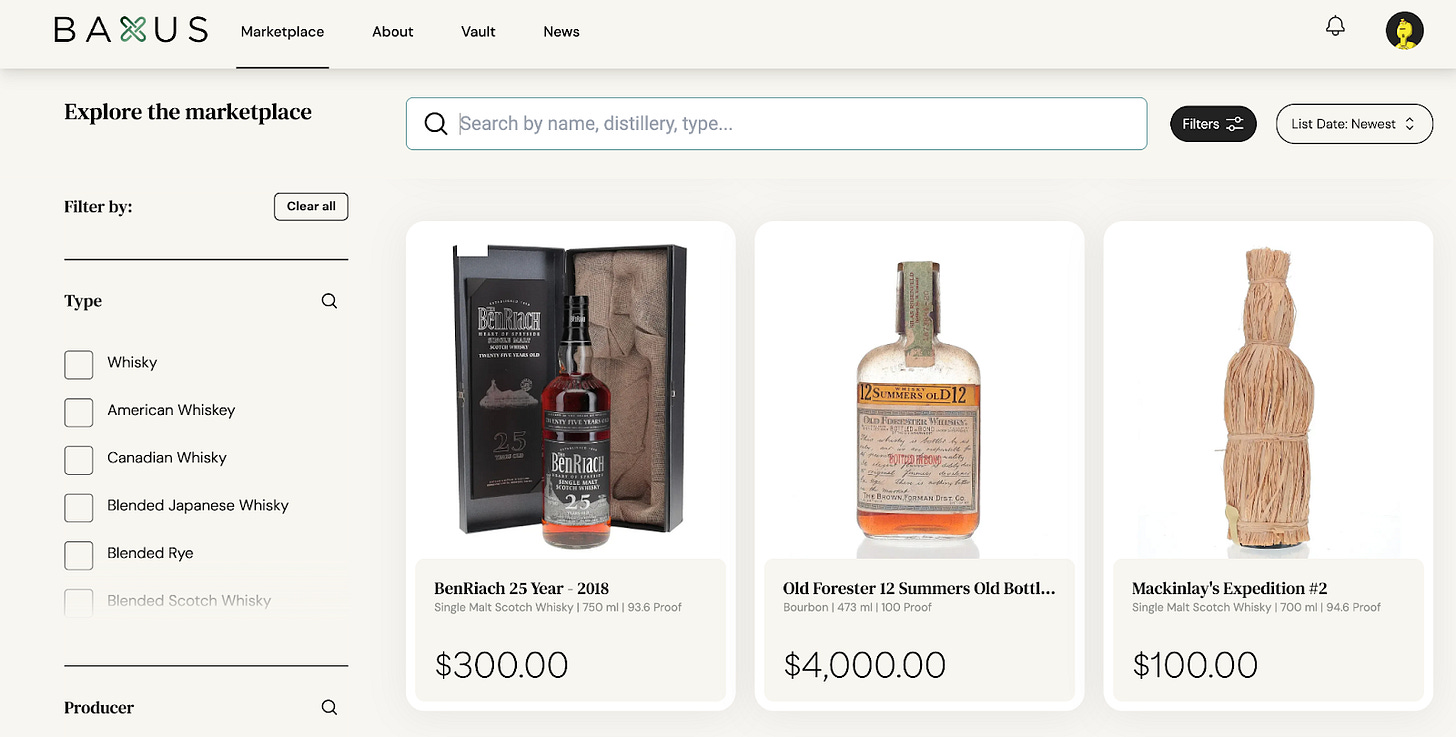

BAXUS is a vertically integrated marketplace that facilitates global trading of rare wine and spirits. Via the Solana blockchain, BAXUS mints tokens representing each of the spirits on the platform.

The user submits their bottle to BAXUS who places the item in a secure vault, where its temperature and humidity conditions are constantly monitored to ensure it remains in quality condition. In return the user receives an NFT in their wallet which they can now list for sale on the global BAXUS marketplace.

If a collector in Hong Kong wants to purchase that bottle, they simply go to the marketplace and purchase the NFT. The bottles are priced in dollars and users can pay via USDC, credit card, or bank transfer.

If they want to redeem for the physical bottle, the NFT is transferred to a BAXUS multisig wallet where it is frozen. BAXUS then ships the bottle out of the vault to a destination of their choosing.

What is the result?

A previously broken, hyper-local medium of exchange for spirit assets is suddenly turned into a liquid global market. With a global market, you enable more efficient price discovery of these assets, resulting in a better experience for both the buyer and the seller. Furthermore, you remove the need for owners to travel with their delicate spirits to auction houses. Disintermediation of the auction house makes the experience both more efficient, convenient, and safer for all parties involved.

The market efficiencies are profound, but they are only one component of the story. Now let’s explore credit.

Credit

In “The Mystery of Capital”, author and economist Hernando de Soto argues that the lack of formal property rights and accounting is the main barrier to the development of capitalism in many parts of the world. Accounting for property provides a way for people to leverage their assets to obtain credit and engage in economic activities. Without them, people are unable to access credit, which leads to a lack of investment, reduced productivity, and economic stagnation.

Applications like BAXUS have solved the property rights and accounting component for the high-end spirits market. But the most beneficial byproduct lies in the ability to obtain credit against these assets.

With a tokenized representation of these spirits, users can simply deposit the NFT into a protocol on Solana and instantly obtain a line of credit against the asset. Since the whiskey market is an appreciating asset class, up 280% in the last decade, lenders can have assurances in the quality of the collateral backing their loan. Additionally, borrowers do not have to worry about rapid fluctuations in the price of their collateral which would otherwise result in a margin call.

The total market cap of all wines and spirits globally is $970B and is anticipated to reach $1.4T by 2027.

And this is just one asset class.

With tokenization, we have the ability to unlock capital in otherwise nebulous industries. When we unlock latent capital, the benefits to society can be profound.

Economic Growth

As stated by De Soto above, a strong driver of economic growth and prosperity for humans in the modern era has been credit. Tokenization of long-tail assets can be the linchpin that enables a step function improvement in global markets and credit growth in the 21st century.

The final step in this journey is how all of these components impact economic growth and produce tangible benefits for humans across the globe. Continuing with the BAXUS example, we’ll now explore how tokenization can facilitate the expansion of spirits’ markets.

Presume you are a start-up whiskey distiller.

You’ve got a great idea for a new blend and intend to bring your product to life. You know that, on average, it takes a minimum of 6 years to age the whiskey before you have a viable product to sell, so you embark on a journey to raise startup capital.

Given the difficult underwriting nature of the asset class, you are unable to obtain capital from a bank. Not many venture investors seem to be interested either as it’s outside the scope of their mandate. The only options available to you are from hedge funds offering sometimes 100% APR or more on the principal.

That is the current state of the whiskey market today.

If you are not a well capitalized individual already, the startup costs are onerous and limit your ability to get off the ground. Even if you do get off the ground, you’re being knee-capped from investing further into your business as you’re stuck paying significant annualized interest.

Enter BAXUS.

Instead of selling your soul to a hedge fund, BAXUS enables new whiskey distilleries to tokenize casks of whiskey and post them as collateral for a loan.

Due to the globally liquid nature of the BAXUS platform, distillers are able to get much more favorable terms, on the order of 12-15% APR.

Additionally, BAXUS’ cask-tracking technology enables distilleries to borrow on a rolling basis, rather than negotiating lump-sum financing packages. This enables them to borrow on an as-needed basis; against as little as one barrel at a time.

With liquid working capital on their balance sheet, they can now fund their operations at a fraction of the cost they might have otherwise gotten. In a few years once the whiskey can be harvested, they can operate their business at significantly more profitable margins. This allows them to further invest in their businesses or consume other goods and services which stimulate the economy.

Wrapping Up

Tokenization, as exemplified by BAXUS in the high-end wine and spirits market, represents a significant leap forward in the application of blockchain technology. This innovation has the potential to revolutionize how we perceive, trade, and leverage traditionally illiquid assets.

By creating global markets, enabling efficient price discovery, and providing access to credit, tokenization is unlocking value that was previously dormant and converting it into kinetic economic energy.

The ripple effects of this transformation extend far beyond the immediate benefits to buyers and sellers. As outlined in the whiskey distillery example, it can lower barriers to entry for entrepreneurs, foster innovation, and stimulate economic growth across entire industries.

While we've focused on the spirits market, the implications of this technology are far-reaching. From collectibles to mineral rights, the potential for tokenization to create more efficient markets and drive economic growth is vast and largely untapped.

As this technology continues to mature and gain mainstream adoption, we can expect to see more innovative applications like BAXUS emerge. These platforms will not only change how we interact with specific asset classes but could fundamentally alter our understanding of ownership, value, and economic participation in the digital age.

For more content like this, follow me on Twitter @bennybitcoins or subscribe to The Elephant